24 Apr 2024 | 15:08:43 GMT+7

-

14:00

China objects to US arms sales to Taiwan

-

13:19

No letup, more hot days ahead

-

13:05

Long Songkran generated B140bn in tourism income

-

12:29

Central bank intervenes to steady baht

-

11:26

Myanmar rebel group withdraws from border town

-

10:40

Keeping rate steady creates policy optionality - central bank

-

POLITICS | 23 Apr 2024

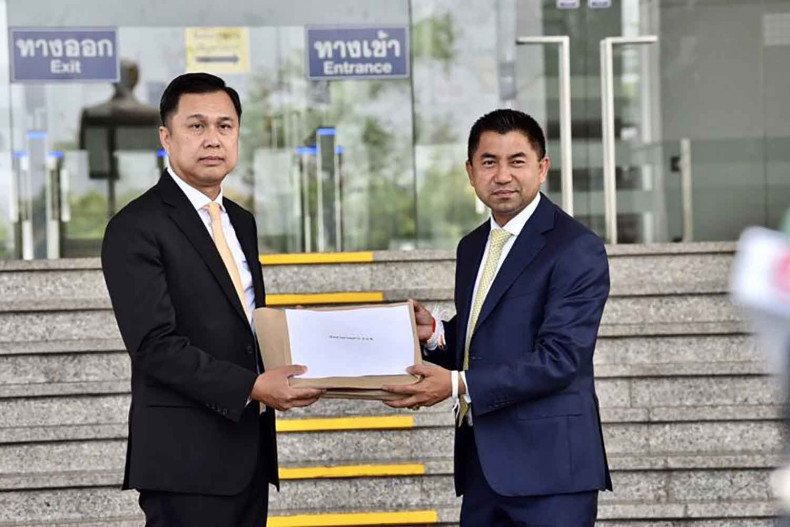

Cabinet approves 3 charter-change referendums

-

POLITICS | 23 Apr 2024

Justice minister shrugs off misconduct petition in Thaksin case

-

POLITICS | 23 Apr 2024

Cabinet mulls three referenda

-

POLITICS | 22 Apr 2024

Move Forward seeks to rein in military 'super board'

SPECIAL REPORT | 22 Apr 2024

PM ready to show his hand

-

SPECIAL REPORT | 21 Apr 2024

Submarine plan triggers internal dispute

-

SPECIAL REPORT | 17 Apr 2024

Cops up ante on foreign criminals

-

SPECIAL REPORT | 16 Apr 2024

Kids drawn to vaping despite proven health risks

-

SPECIAL REPORT | 8 Apr 2024

BRT set to see upgrades

-

MOTORING | 23 Apr 2024

China's Chery lands BOI perks for Rayong EV plant

-

MOTORING | 22 Apr 2024

China's Chery Automobile to set up Thai assembly plant

-

MOTORING | 18 Apr 2024

EV sales expected to miss target

-

MOTORING | 18 Apr 2024

PTT touts hydrogen as fuel of the future

INVESTMENT | 06:42

A tale of two havens

-

INVESTMENT | 05:30

Government Pension Fund expects to shift focus to gold, oil to mitigate risk

-

INVESTMENT | 23 Apr 2024

All eyes on first-quarter earnings

-

INVESTMENT | 20 Apr 2024

SET strives to get above 1,400 hurdle

-

INVESTMENT | 20 Apr 2024

Asian shares slump as Mideast risk rises

Currency/Baht

Buy (Baht)

Sell (Baht)

USD

USD

36.8732

37.1995

GBP

GBP

45.3253

46.1795

EUR

EUR

39.1086

39.8201

JPY

JPY

23.6224

24.2879

HKD

HKD

4.6864

4.7665

CNY

CNY

5.0462

5.1796

Source: Bank of Thailand (24 Apr 2024)

BANGKOK

Clouds

34°/38°

CHIANG MAI

Clear

34°/39°

PATTAYA

Clouds

30°/37°

SURAT THANI

Clouds

33°/37°

PHUKET

Clouds

35°/35°

KANCHANABURI

Clouds

41°/41°

Source: openweathermap.org (24 Apr 2024)

SET

1,360.90

+3.44

SET50

834.49

+2.29

SET50FF

830.97

+1.10

SET100

1,847.04

+4.75

SET100FF

1,840.44

+2.62

sSET

860.58

-1.45

SETCLMV

815.31

-0.87

Source: settrade.com (24 Apr 2024)

Buy (Baht)

Sell (Baht)

GOLD (1 BAHT WEIGHT, 96.5%)

Buy (Baht)40,550.00

Sell (Baht)40,650.00

ORNAMENT (1 BAHT WEIGHT, 96.5%)

Buy (Baht)39,825.32

Sell (Baht)41,150.00

Source: GoldTraders (24 Apr 2024)

Date: 24 Apr 2024

Type

Today

Tomorrow

45.14

45.14

30.94

30.94

30.94

30.94

30.94

30.94

Type

Today

Tomorrow

37.59

37.59

37.84

37.84

38.88

38.88

39.95

39.95

Effective and projected prices as at 23 April 2024, 05:00 AM

CHECK OUT YOUR WEEKLY HOROSCOPE

STAY INFORMED.

GET DAILY UPDATES FROM THE BANGKOK POST.

By subscribing, you accept the terms and conditions in our privacy policy.