25 Apr 2024 | 08:54:22 GMT+7

BUSINESS

25 Apr 2024

The thorny issue of digital wallet funding

THAILAND

25 Apr 2024

Thailand proposes peace plan

BUSINESS

25 Apr 2024

Central bank urges banks to help vulnerable

LIFE

25 Apr 2024

A coastal gem

-

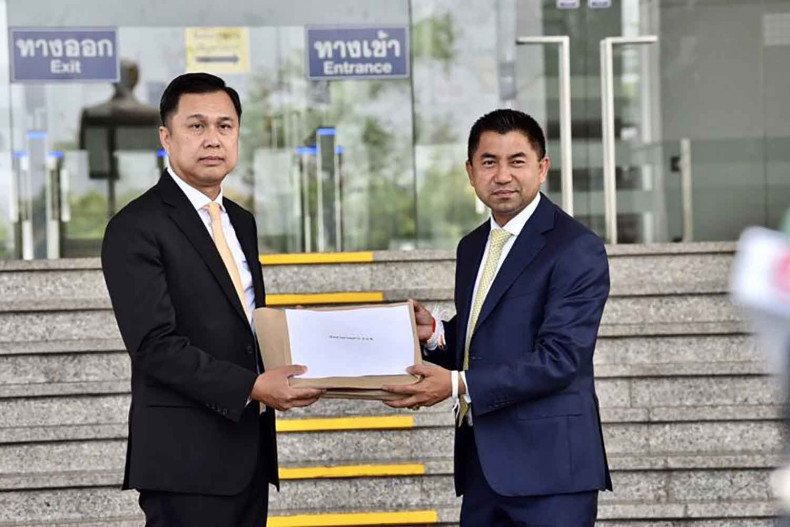

POLITICS | 24 Apr 2024

Move Forward seeks 15 more days to file defence

-

POLITICS | 24 Apr 2024

Gen Prawit declares assets of B87m

-

POLITICS | 24 Apr 2024

Cabinet clears path for election

-

POLITICS | 23 Apr 2024

Cabinet approves 3 charter-change referendums

SPECIAL REPORT | 22 Apr 2024

PM ready to show his hand

-

SPECIAL REPORT | 21 Apr 2024

Submarine plan triggers internal dispute

-

SPECIAL REPORT | 17 Apr 2024

Cops up ante on foreign criminals

-

SPECIAL REPORT | 16 Apr 2024

Kids drawn to vaping despite proven health risks

-

SPECIAL REPORT | 8 Apr 2024

BRT set to see upgrades

-

PR NEWS | 08:00

CMG Boosts Vietnam Footprint with New FitFlop Store Opening

-

PR NEWS | 24 Apr 2024

EFT Solutions Successfully Showcases in Money 20/20 Asia

-

PR NEWS | 24 Apr 2024

Thailand Tops Japanese Golden Week Travel Choices

-

PR NEWS | 24 Apr 2024

Huawei Calls on Developers to Build Native Apps for HarmonyOS

-

MOTORING | 23 Apr 2024

China's Chery lands BOI perks for Rayong EV plant

-

MOTORING | 22 Apr 2024

China's Chery Automobile to set up Thai assembly plant

-

MOTORING | 18 Apr 2024

EV sales expected to miss target

-

MOTORING | 18 Apr 2024

PTT touts hydrogen as fuel of the future

-

INVESTMENT | 24 Apr 2024

Government Pension Fund expects to shift focus to gold, oil to mitigate risk

-

INVESTMENT | 24 Apr 2024

A tale of two havens

-

INVESTMENT | 23 Apr 2024

All eyes on first-quarter earnings

-

INVESTMENT | 20 Apr 2024

SET strives to get above 1,400 hurdle

Currency/Baht

Buy (Baht)

Sell (Baht)

USD

USD

36.7523

37.0816

GBP

GBP

45.5421

46.395

EUR

EUR

39.1315

39.8682

JPY

JPY

23.5153

24.2012

HKD

HKD

4.6704

4.7579

CNY

CNY

5.0251

5.1624

Source: Bank of Thailand (25 Apr 2024)

BANGKOK

Clear

29°/30°

CHIANG MAI

Haze

28°/33°

PATTAYA

Clouds

29°/32°

SURAT THANI

Clouds

28°/30°

PHUKET

Clouds

28°/31°

KANCHANABURI

Clouds

31°/31°

Source: openweathermap.org (25 Apr 2024)

SET

1,361.10

-

SET50

834.74

-

SET50FF

831.95

-

SET100

1,847.27

-

SET100FF

1,841.88

-

sSET

859.70

-

SETCLMV

817.65

-

Source: settrade.com (25 Apr 2024)

Buy (Baht)

Sell (Baht)

GOLD (1 BAHT WEIGHT, 96.5%)

Buy (Baht)40,500.00

Sell (Baht)40,600.00

ORNAMENT (1 BAHT WEIGHT, 96.5%)

Buy (Baht)39,764.68

Sell (Baht)41,100.00

Source: GoldTraders (25 Apr 2024)

Date: 25 Apr 2024

Type

Today

Tomorrow

45.14

45.14

30.94

30.94

30.94

30.94

30.94

30.94

Type

Today

Tomorrow

37.59

37.59

37.84

37.84

38.88

38.88

39.95

39.95

Effective and projected prices as at 23 April 2024, 05:00 AM

CHECK OUT YOUR WEEKLY HOROSCOPE

STAY INFORMED.

GET DAILY UPDATES FROM THE BANGKOK POST.

By subscribing, you accept the terms and conditions in our privacy policy.